MIRA Calls Upon Taxpayers That Do Not Meet Registration Requirements to Deregister

The MIRA has issued announcements requesting taxpayers who do not fulfil tax registration requirements under the Tax Administration Act, or GST registration requirements to deregister from tax.

The announcement, issued on 16 January 2019, reminds…

Cash Declaration Limit Changed

The Maldives Monetary Authority, on 17 January 2019, published the first amendment to the Regulation on Cross Border Currency Declaration Amount.

The changes introduced now require passengers travelling with USD 20,000 or more, and are travelling…

New Commissioner General Appointed to MIRA

On 31 October, President Ibrahim Solih, appointed Fathuhulla Jameel as Commissioner General of Taxation and Asma Shafeeu as Deputy Commissioner General of Taxation.

Fathuhulla, a veteran in the field of revenue and taxation, was among several applicants…

Overview of Income Tax Bill

This publication gives an overview of the Income Tax Bill submitted to the Parliament by the Government of Maldives on 15 October 2019. The Parliament has commenced debate on the Bill, and is expected to bring changes to the Bill, before voting…

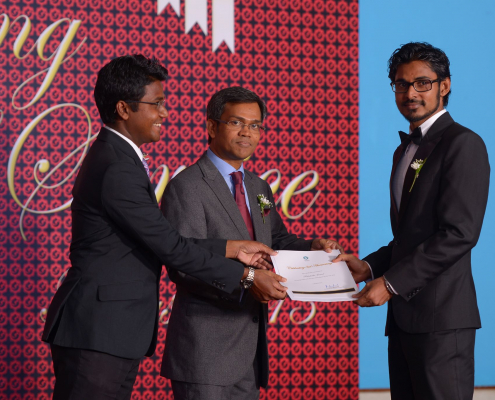

New Commissioner General Approved by Majilis

On 28 October 2019, the People’s Majilis approved Fathuhulla Jameel as the new Commissioner General of Taxation of the Maldives Inland Revenue Authority.

Following the second amendment to the Tax Administration Act, a new Commissioner General was…

Income Tax Bill submitted to the Parliament

The Government of Maldives has sent the draft of the Income Tax Bill (“ITB”), intended to introduce Personal Income Tax and redesign the existing Business Profit Tax regime, to the Parliament today, 15 October 2019.

Under the proposed Bill, the…

Tax Alert, 15 October 2019

This issue covers the major changes that came into force with the ratification of the Second Amendment to the Tax Administration Act1 on 12 September 2019.

Some of the key changes brought by the Amendment include:

Imposition of a statutory limitation…